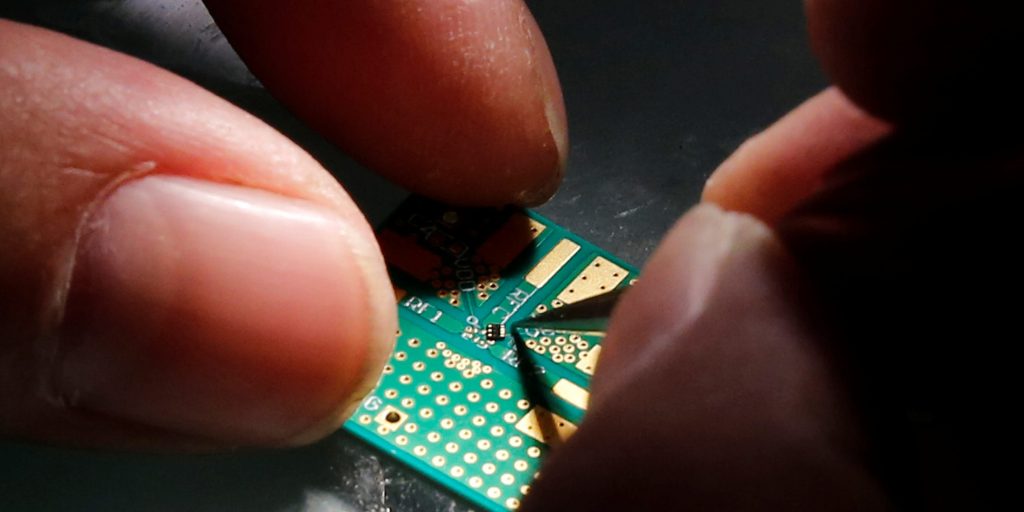

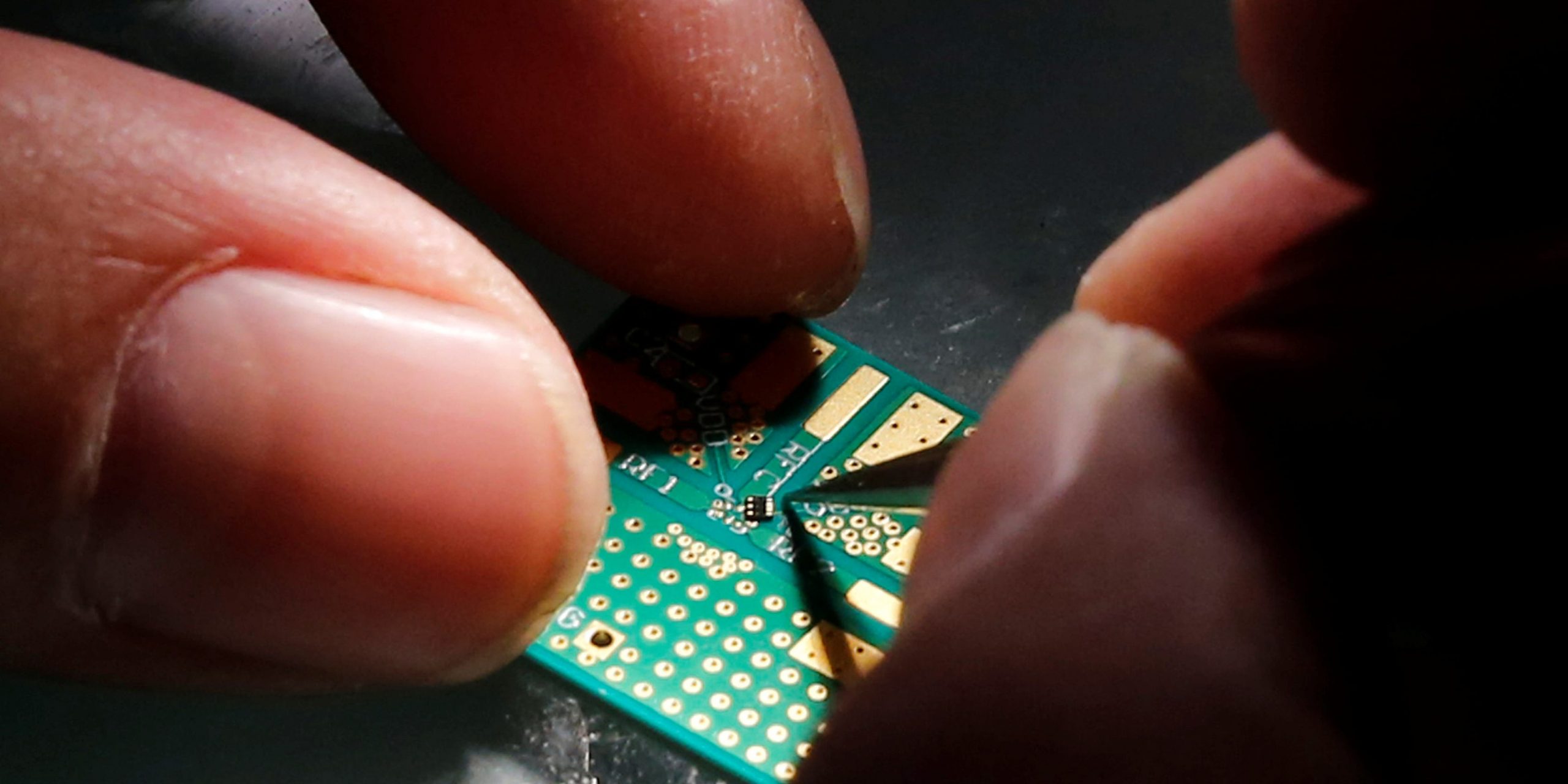

Reuters

- Semiconductors are an increasingly important component of products from laptops to lightbulbs.

- Surging demand and disrupted supply have led to a severe lack of chips for a variety of industries.

- Industry leaders and analysts are forecasting at least another year of shortages.

- See more stories on Insider's business page.

Semiconductor chips are in almost everything these days.

As Glenn O'Donnell, a vice president at Forrester Research, put it, "if it has a plug or a battery, it is probably full of chips."

The global chip shortage that is jamming up auto manufacturers is rippling across nearly every industry that makes or uses tech-enabled products.

In particular, analysts say the boom in cloud computing and cryptocurrency mining, as well as the embedding of smart features in everything from doorbells to dishwashers, has led to a gold rush in the sector.

Read more: Auto Chip Crisis Is Threatening Recovery From the Pandemic

But a combination of factors have pinched the supply as demand continues ramping up, leading to severe shortages that industry leaders and analysts say could drag out into 2023.

"We are looking at couple of years… before we get enough incremental capacity online to alleviate all aspects of the chip shortage," IBM President Jim Whitehurst told the BBC. His company licenses microprocessor technology to the world's leading chip makers.

Last week, Reinhard Ploss, CEO of German chipmaker Infineon, told CNBC his industry has never seen conditions like these, but that two years to normal seemed "too long."

Other firms have painted even rosier forecasts - Taiwan Semiconductor Manufacturing Company (TSMC), the largest chip maker, said it expects to catch up with auto industry demand next month, and Cisco CEO Chuck Robbins, told the BBC the shortage would wind down later this year.

Analysts, however, are skeptical.

"Because demand will remain high and supply will remain constrained, we expect this shortage to last through 2022 and into 2023," O'Donnell wrote on a Forrester blog. "We see nothing but boom times ahead for chip demand."

Plurimi Investment Managers CIO Patrick Armstrong told CNBC he expects another 18 months of shortfalls.

"It's not just autos. It's phones. It's the internet of everything. There's so many goods now that have many more chips than they ever did in the past," he said. "They're all internet enabled."

New production is coming online, with a $20 billion spend from Intel and a $28 billion investment from TSMC, but that does little to solve the immediate challenge facing the market right now.

Nobody is literally filling trash bags or gas cans with semiconductors, but Credit Suisse's director of global economies and strategy, Wenzhe Zhao, said last week that inventory hoarding along the production chain is making a tight supply situation even worse.

For now, Forrester's O'Donnell recommends tech buyers be patient, pay more, pick an alternative product or service, or make do with older tools until things return to normal.